California

Asset Protection Lawyer

Setting up an asset protection plan is a complex and challenging task in today’s environment. The plan not only needs to be properly designed, but it also needs to be properly implemented. Just as a Living Trust is of small use if it is not funded, an asset protection plan is of little use unless it is funded and the documentation is done correctly. Whether it is a limited partnership, limited liability company, trust, corporation or some other asset protection vehicle, we can assist you in structuring your plan and interrelating the various entities for maximum benefit.Asset protection planning involves developing and applying a lawful series of techniques that protect your assets from claims of future creditors. The techniques are designed to deter potential creditors from going after you, and frustrate them if they do, generally by making it difficult or impossible for future creditors to grab hold of your assets or collect judgments against you.

In cases where significant sums are involved, asset protection planning often includes setting up a series of trusts, partnerships and/or off-shore entities to hold legal title to your assets. As a result, a future creditor who recognizes how difficult it would be to collect on any judgment it may win might decide it makes little sense to pursue a claim, or be willing to settle for pennies on the dollar.

There is a very sharp dividing line between “legal” asset protection planning on the one hand, and actions to defraud creditors, which are criminal, on the other. For that reason, it is essential to have an attorney guide you through the process.

Asset Protection with Multi-Level Entities

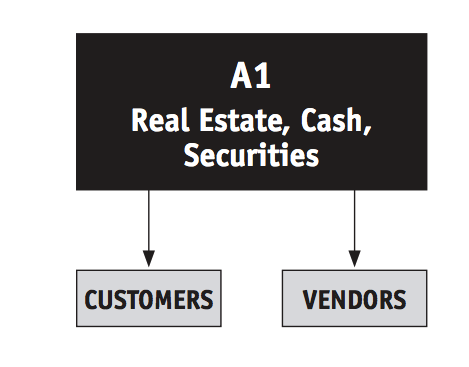

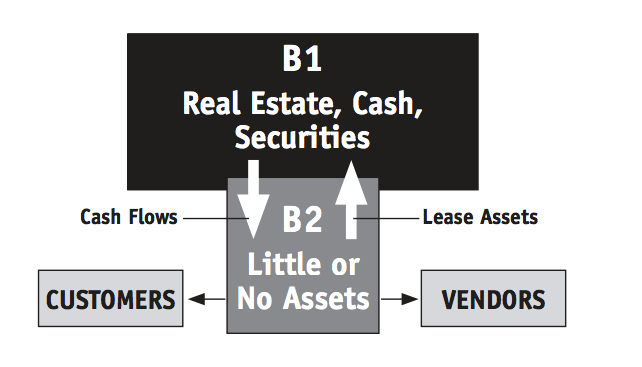

Illustrated Example: Business One “A1” owns its own assets, and contracts directly with its customers and vendors; thereby subjecting itself to creditor risk. Business Two holds its assets in “B1” and contracts with vendors and customers through “B2”; thereby limiting its liability only to those assets within “B2”.

Should you consider Multiple Business Entities as an Asset Protection Tool?

It is common to see a business accumulate various assets (cash, real estate, securities, etc.) not related to the direct operation of the business. Aside from other potential issues and/or risks, doing so subjects all of the assets to the vulnerabilities of each individual asset. Imagine an Ice Cream company so popular that it has enough profits to invest in apartment buildings. One day, a terrible accident occurs in the boiler room of one of the apartment buildings, and a maintenance worker is severely injured. A lawsuit is filed and a judgment is entered in favor of the worker. Unfortunately, the accident left the maintenance worker paralyzed for life, with significant damages as a result. Presumably, he will seek recovery from the building’s insurance carrier but, alas, the building was underinsured for such a catastrophe. Where else will the worker look to recover the remaining damages? As owner of the apartment building, the Ice Cream Company is liable and will potentially lose all of its assets, including its ice cream inventory. (See page 2 for an illustrated example).

One possible solution is to simply remove the assets out of the business via distribution to the owners. However, this approach simply shifts the risk from the business to the owner. In other words, while the assets are in the business, they are subject to the business’s creditor claims, and when distributed to the owner, the assets are subject to the owner’s creditor claims. A comprehensive approach to Asset Protection must address both of these competing interests.

Fortunately, there is a relatively straightforward solution to this dilemma.

The business owner should consider establishing multiple divisions of the company. In its basic form, this means creating an operating company and a holding company. The holding company (also known as the management company) manages the other divisions (i.e., other companies) and receives compensation for its efforts. Additionally, the holding company owns most of, if not all, the assets and loans those assets to the operating company.

It is important to ensure that only the operating company contracts with any outside vendors and customers. This way, only the operating company is subject to risk of loss, due to vendor and customer claims and lawsuits. Even in the case of a potential claim or lawsuit, since the operating company does not own any assets (rather, it leases assets provided by the holding company), the operating company has no assets to lose. Notably, the operating company will have recurring cash flows and receivables that may be subject to creditor claims, but most of these funds (minus operating expenses, of course) should be consistently paid to the holding company, in the form of management fees.

Utilizing this strategy will, admittedly, cause additional administrative, accounting, legal, and logistical difficulties. Yet, for a company with substantial assets, it is easy to see that the Asset Protection benefits quickly outweigh the burdens. For those for whom the benefits don’t (yet) outweigh the burdens, there is another solution: Series LLCs.

For our purposes, suffice to say that although LLCs are relatively young in comparison to other business forms, they have quickly become the top entity choice for businesses, based upon their easy manageability and

LLCs are especially ideal for the multiple-entity approach explained earlier. However, while they may be the ideal entity choice for our strategy, maintaining multiple LLCs does not deal with the problem of added administrative, accounting, legal, and logistical burdens.

In 1996, Delaware became the first state to enact a series limited liability company statute and, since then, a handful of states have developed similar statutes. A series limited liability company provides limited liability to the owners (members, in the case of LLCs) of each entity in the series. Each series of an LLC is essentially its own separate entity, with distinct assets, liabilities, managers, and members.

This structure is similar to the multiple-entity approach explained earlier, but different in a few important respects. The primary difference is that a single operating agreement can be used to easily establish (and terminate, if need be) multiple and separate LLCs. This feature, at least partially, lessens the added cost and administrative burdens of the multiple-entity approach. However, because very few statutes and very little caselaw and administrative guidance exist on the use of series LLCs, it is especially important to seek advice from a knowledgeable attorney.

Generally, it is our firm’s philosophy that Asset Protection requires a multi-disciplinary approach, in order to properly design and execute. The knowledgeable legal practitioner must have an established degree of expertise within Business, Estate Planning, Tax & Finance. By drawing upon these various disciplines, the attorney can provide counsel with regard to strategy design and implementation.

*This article was written by Robert Vaksman, Esq., LLM and published by Wealth Counsel, LLC Estate Planning Strategies

Asset Protection FAQ

An easy way to obtain some asset protection is to setup limited liability companies (LLC’s) for your properties. The next level of asset protection would be an irrevocable trust, which would only be possible for properties that do not have mortgages on them.

SUBMIT YOUR CONTACT DETAILS 100% Free Consultation, Always. Free Consultation.